Nonprofit Organization Viability Scores (NOVA)

Much has been written about the state of American higher education and the factors that are coalescing to threaten the viability of many long-standing institutions. Many relevant, small-to-mid-sized private schools are experiencing trended declines in both enrollment and available high school applicants. Extensive media coverage calling into question the value and relevance of a college education has exacerbated the problem for many institutions. Taken as a collective whole, these factors and market forces pose substantial risks to the viability of some segments of the higher education industry.

Private, independent colleges and universities comprise a segment of the higher education market that is experiencing significant disruption. Specifically, this sector includes a collection of small-to-mid-sized institutions that has seen 86 school closures nationally (concentrated in the Northeast) since 2016 with more projected.

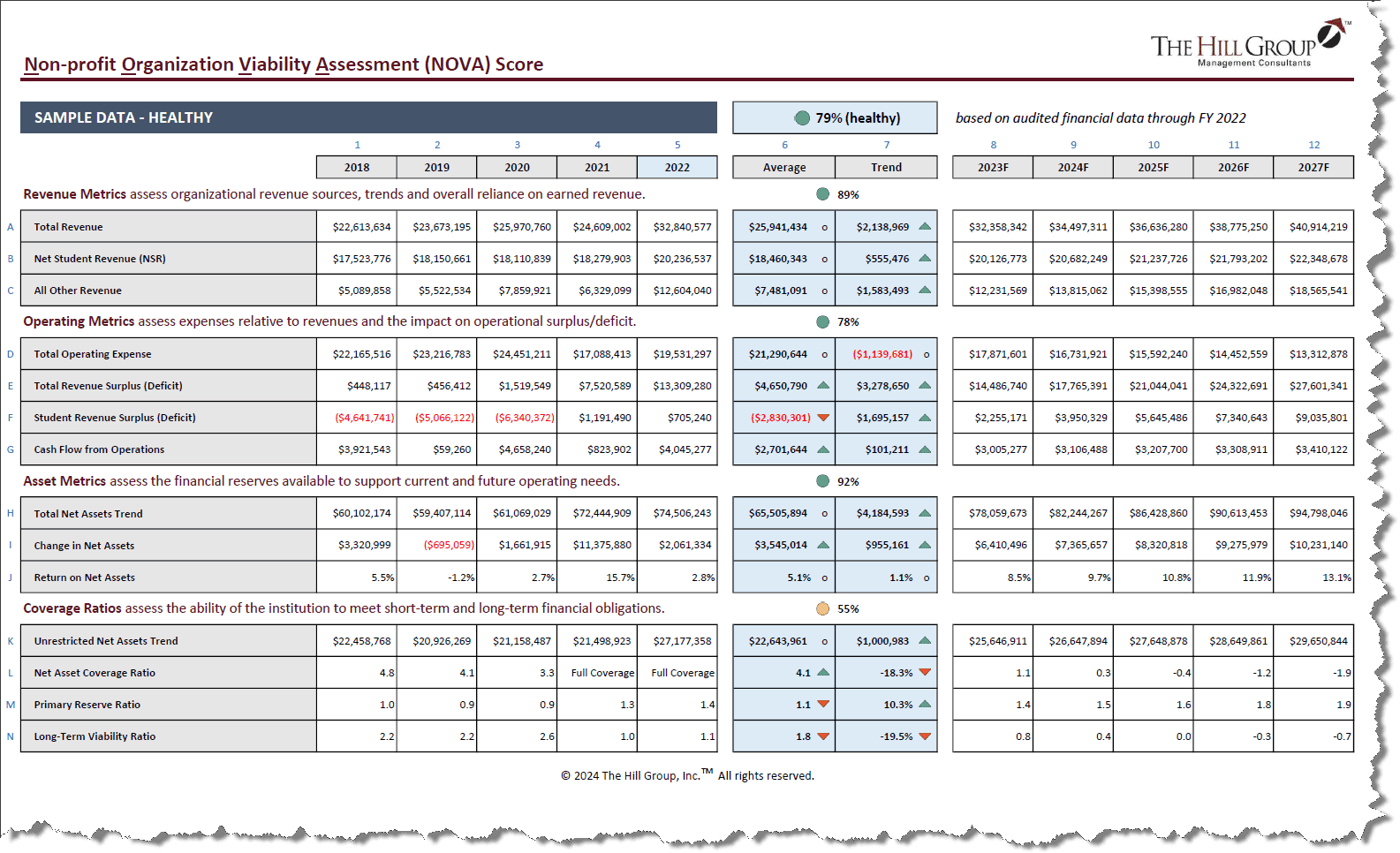

Healthy - Anonymous College/University

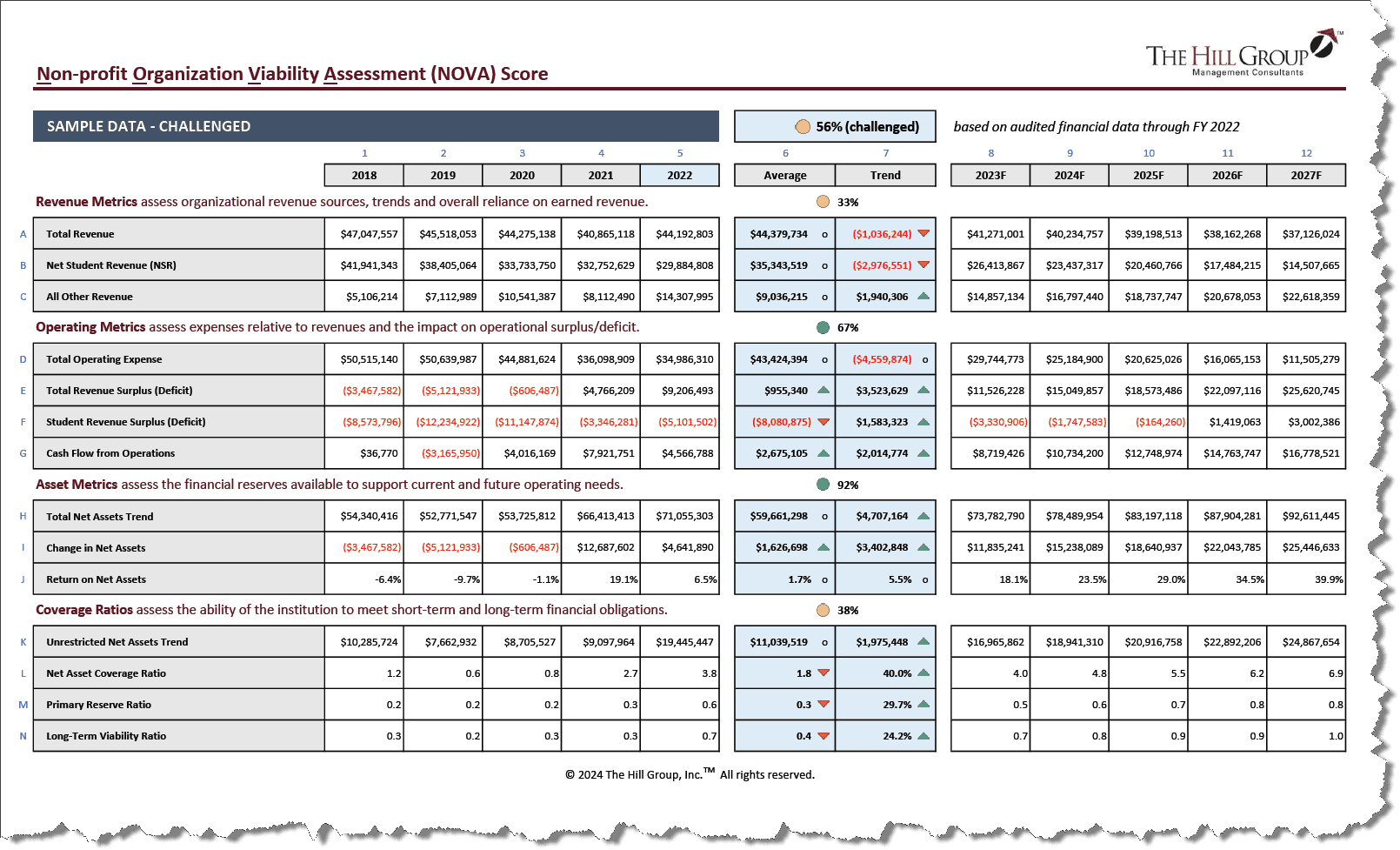

Challenged - Anonymous College/University

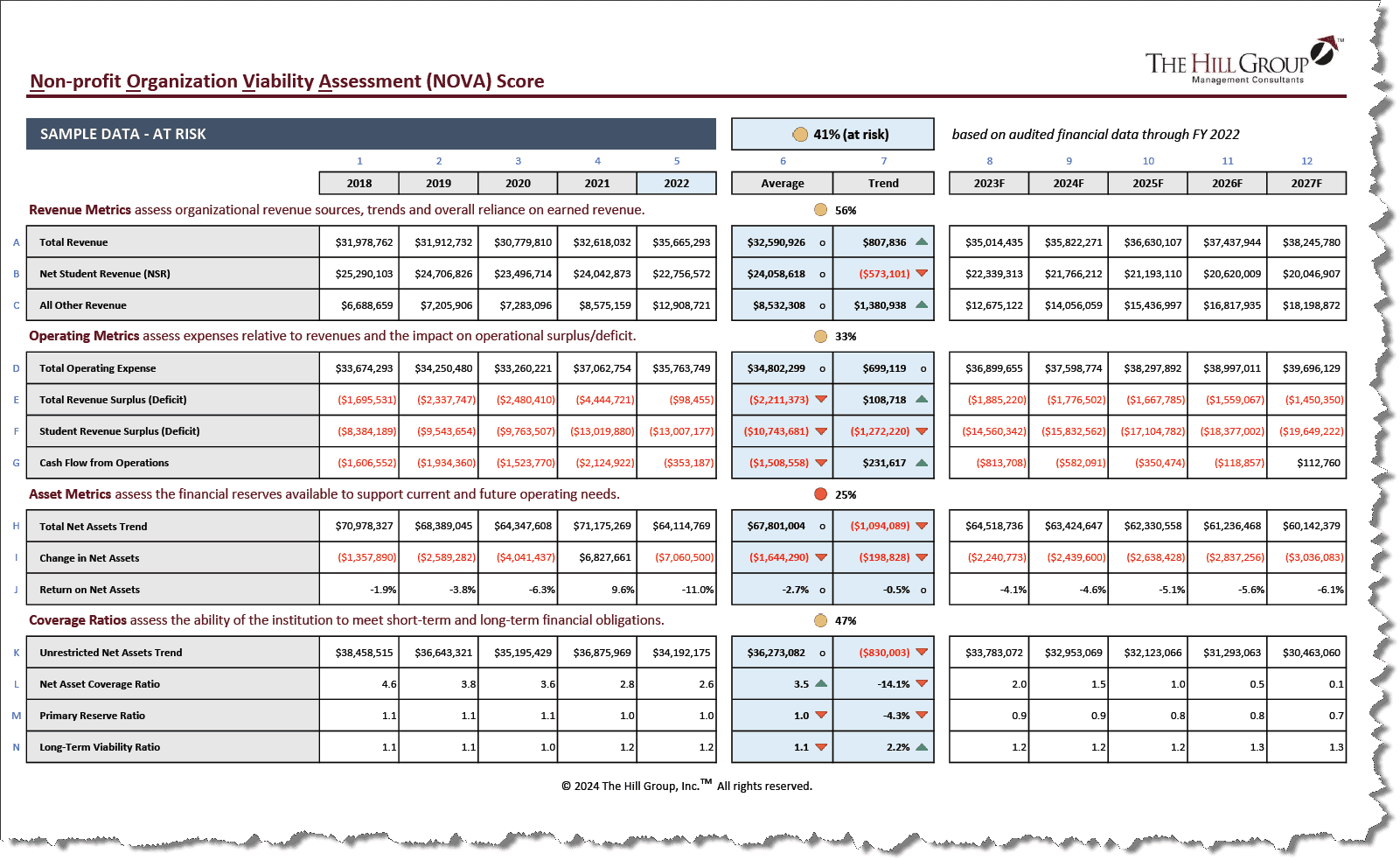

At-Risk - Anonymous College/University

In Danger - Anonymous College/University

Methodology

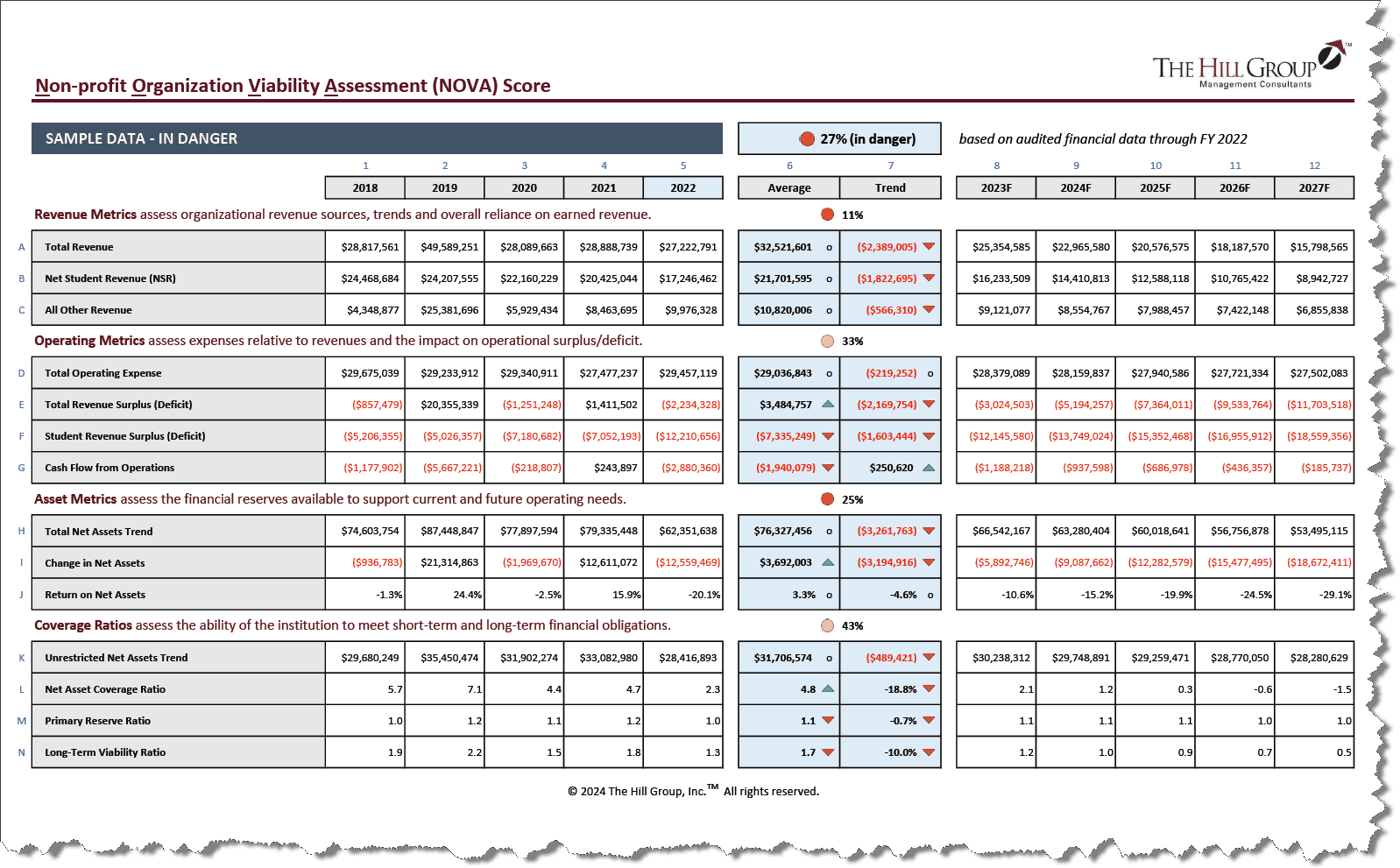

The Hill Group developed a financial viability model to dramatically improve previous methodologies, like the Forbes’ College Grade and the College Stress Test. This new approach, The NOVA (Nonprofit Organization Viability Assessment) Score, uses your school’s publicly available, audited financial statements over the last five years to show the unrestricted cash position of the school for the next five years. This methodology allows you and your Board to clearly see what the immediate future holds.

The Hill Group set out to develop an improved financial viability model with three primary goals:

- The assessment must include the most up-to-date performance data available to ensure timely and reliable evaluation of financial viability. For this reason audited financial statements were chosen as the best readily-available source of input data.

- It must be possible to conduct the assessment based on data available for a single institution without reliance on relative standing among a group of peers within the sector. An absolute reference point is critical to address scenarios where macro-economic factors (e.g., declining enrollments, the COVID pandemic, short-term movements in asset values) cause all institutions to benefit or struggle together. Unfortunately, it is possible for all organizations to exhibit a decline in financial health simultaneously, and the ideal scoring methodology must account for this possibility.

- The key metrics chosen for assessment must be comprehensive, scalable and balanced. Comprehensive means that key metrics should cut across all fundamental elements of financial health from Revenue, to Operating Expense, to Assets and Liabilities. Scalable means that small and mid-sized institutions are not penalized for operating efficiently at a smaller scale. Balanced means that the scoring methodology must consider both the current state and the long-term trend for each key metric.

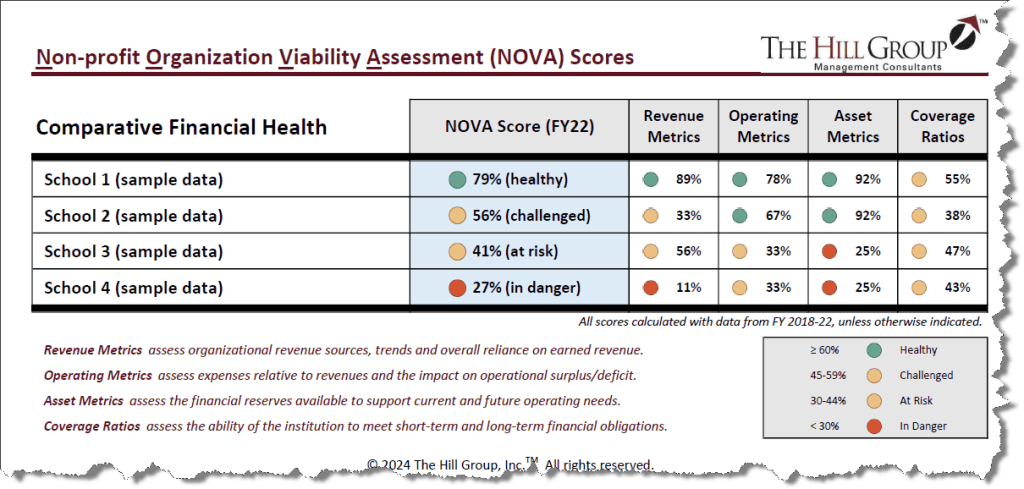

The Hill Group developed the Non-profit Organization Viability Assessment (NOVA) Score to address these three goals and create an up-to-date, stand-alone, comprehensive, scalable, and balanced methodology for the assessment of higher education institutions and other non-profit organizations reporting financial data in a similar format. The NOVA Score utilizes data from audited financial statements to generate 12 key metrics for evaluation that can be broadly grouped into Revenue Metrics, Operating Metrics, Asset Metrics and Coverage Ratios.

Revenue Metrics assess organizational revenue sources, trends, and overall reliance on earned revenue, which in the case of higher education is student-derived revenue. Operating Metrics assess expenses relative to revenues and the impact on operational surplus or deficit for each institution. Asset Metrics assess the financial reserves available to support the current and future operating needs of the organization. Finally, Coverage Ratios assess the ability of the institution to meet both short- and long-term financial obligations.

Five years of audited financial data are collected for each school included in the assessment, from which overall averages and annualized trends are calculated for each key metric. These averages and trends are then normalized into a standardized rating using either 5-year average revenue or another scalability metric as a denominator, ensuring comparability across differently-sized institutions. Each normalized rating is then assigned a score from 0 to 3.

Depending on the metric, the scores for the average, the trend, or both are assigned a weight (out of 100) within the overall calculation. In summary, Revenue Metrics comprise 30% of the calculation, Operating Metrics comprise 30%, Asset Metrics comprise 20%, and Coverage Ratios comprise 20%. This mix achieves an appropriate balance of factors to accurately represent the overall financial health and viability of each institution.

All individually-weighted scores are combined into an overall NOVA Score – calculated as the percent of rating points achieved out of a maximum of 300 across all metrics (maximum of 3 points per rating with 100 total weighting points assigned). In summary, final scores may range from 0-100%, with a score ≥ 60% indicating “Healthy,” 45-59% indicating “Challenged,” 30-44% indicating “At Risk,” and finally <30% indicating the institution is “In Danger.”

For more information about NOVA Scores and how The Hill Group can help your college or university, see our Higher Education page and contact:

Dr. Paul Hennigan

Senior Consultant

phennigan@hillgroupinc.com

412-722-111